Grow your savings with higher rates and total confidence.

Tiered dividends

Bigger balances can take your earning power to higher levels.

No time commitment

Start earning money on day one and make withdrawals as you wish.

Convenient access

Make use of your Money Market funds through special checks, and digital banking tools.

Total security

The National Credit Union Administration insures all deposits up to $250,000.

Put your money in position to work even harder with higher yields.

There are countless saving strategies and investment tools available, but you may prefer to keep it safe and simple. Our Money Markets earn more than traditional savings accounts, provide fast access to funds, and come with assurances that your funds are always secure.- Make unlimited deposits.

- Begin earning dividends on balances of $1,000 or more.

Effective Date: December 24, 2024

| From | To | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|---|

| $1,000.00 | $9,999.99 | 0.05% | 0.05% |

| $10,000.00 | $24,999.99 | 0.10% | 0.10% |

| $25,000.00 | $49,999.99 | 0.15% | 0.15% |

| $50,000.00 | $99,999.99 | 0.65% | 0.65% |

| $100,000.00 | $249,999.99 | 1.00% | 1.00% |

| $250,000.00 | $499,999.99 | 1.24% | 1.25% |

| $500,000.00 | $999,999.99 | 1.49% | 1.50% |

| $1,000,000.00 | $2,999,999.99 | 3.20% | 3.25% |

| $3,000,000.00 | or more | 3.69% | 3.75% |

Open your Money Market account.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

- Make an Appointment and What to Bring Information

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

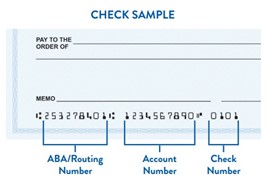

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking6All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., you are automatically enrolled in eStatements.

Managing your money made easy.

Simplify money management with flexible checking features that fit your lifestyle.