A low-hassle, high-performance account that makes it easy to avoid monthly fees and even easier still to manage your money anytime from anywhere.

- Instant issue Mastercard® Debit Card.

- Online and Mobile Banking*.

Enjoy premium features and benefits with our best checking account.

- Dividends each day your balance is $2,500+1.

- 0.50% APR reduction2 on vehicle loans.

Feel confident handling your finances without much outside help? We have an account designed for your DIY state of mind.

- 24/7 Online Banking and electronic Bill Pay3.

- Free Mobile Banking* and mobile check deposit.

Get your financial journey started with all the benefits of our Simple Checking account, without the worry of a monthly maintenance fee.

- No monthly checking fee.

- Free Online Banking, Mobile Banking*, and Bill Pay.

For your dedication and service, you deserve the best. That's why we waive the monthly maintenance fee on our best checking account.

- Discounted vehicle loan rates and safe deposit boxes.

- Free foreign ATM use.

Sure, they make purchasing easier. And you can get cash from ATMs. But at South Carolina Federal Credit Union, our debit card offers so much more.

- Premium checking members can earn points and shop for rewards.

- Mastercard® security benefits.

- $100 sign-on incentive - certain restrictions apply4.

- Concierge-level service.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

- Make an Appointment and What to Bring Information

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

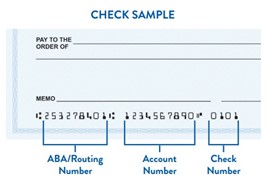

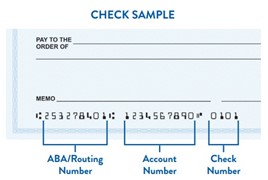

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

South Carolina Federal's routing (MICR) number is 253278401. Your account number is the second string of characters at the bottom left of your check. You can also locate your account number by clicking on the eye icon within Online or Mobile Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

If this is not your first time ordering checks, follow these steps:

- Log into Online Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

- Click on one of your accounts.

- Click on "More Actions."

- Click on "Order Checks."

- Click "Continue."

- Follow the remaining steps.

Here are some tools to help you stay on top of your finances and avoid overdrafts:

-

Budget: Check out our budgeting tips to help you make better financial decisions.

-

Enroll in Direct Deposit: Direct Deposit lets you receive your paychecks faster and helps ensure you have the money you need, when you need it.

-

Enroll in Online Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates.: Check your balances and account history, schedule transfers, receive mobile account alerts and deposit checks through Remote Deposit; all through the convenience of Online Banking.