Our competitive rates make your dollars grow faster.

Most Popular

All you need is $10 to establish your South Carolina Federal Membership.

- Earn dividends on any balance over $150.

Most Popular

Boost your earnings with our Money Market account, where higher balances mean higher dividends.

- Earn tiered dividends with any balance over $1,000.

- Deposits are insured up to $250,000.

Most Popular

Save for the future by starting today.

- Share Certificates

- IRA Savings

- IRA Certificates

Most Popular

Help your children learn about money management by providing a secure account to save for the future.

- Earn dividends on balances as low as $5.

- Offers peace of mind for parents and a strong financial foundation for young savers.

Most Popular

Save year-round to be ready for the holiday season.

- Make unlimited deposits.

- Automatically receive funds November 1.

Looking to open a savings account?

Pick the account that works best for you, and then apply by:

- Calling us at (800) 845-0432

- Visiting a financial center near you

- Apply online here (Money Market accounts only)

Contact South Carolina Federal Credit Union for your savings account needs!

Fill out our quick form and we'll help you get started.

This form is not a secure form of communication. If any confidential information such as account numbers, SSNs, etc. is necessary, it will not be obtained until we have contacted you. This is another way South Carolina Federal works to keep your information secure.

Make informed financial decisions with helpful resources.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

- Make an Appointment and What to Bring Information

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

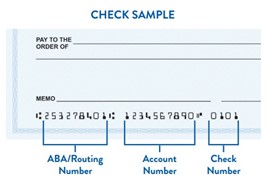

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking6All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., you are automatically enrolled in eStatements.