Learn about the common types of scams to protect your finances.

At South Carolina Federal Credit Union, we understand how important it is to protect your hard-earned money. Financial fraudsters are becoming harder to recognize, making it more imperative than ever to stay informed about current scams and how to spot them. Here are a few common scams to look out for and what to do if you encounter them:

Fake Checks

Fraudsters will send a counterfeit check, often for a large amount of money, and ask you to deposit it into your account. Then, they will ask you to wire a portion of the funds back to them.

Be wary of any unsolicited checks you receive, especially from unknown sources. Do not send money "back" to anyone who claims to send you a free check. If you receive a check that seems suspicious, do not deposit it and contact us as soon as you can.

Be wary of any unsolicited checks you receive, especially from unknown sources. Do not send money "back" to anyone who claims to send you a free check. If you receive a check that seems suspicious, do not deposit it and contact us as soon as you can.

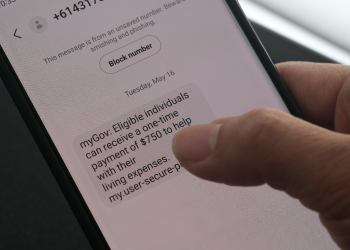

Phishing

Phishing experts use emails or texts that appear to be from financial institutions, popular retailors, or someone you may know. These messages typically have misspelled words or grammatical errors, and ask you to provide personal or financial information.

Read More

Imposter

Imposters may try to convince you to send them money by pretending to represent trustworthy, well-known organizations, such as the county sheriff, the IRS, or charities. Scammers may even pretend to be a family member and try to guilt trip you into sending them money.

Read More

Debt Collection

Fraudsters pose as debt collectors and attempt to collect debts that you do not owe, or that you have already paid. If you receive a call or message from a debt collector, ask for written verification of the debt. Do not provide your personal information until you can confirm that the collection agency is legitimate.

Here to help you